Reimagining

Real Estate

Investing

Providing an innovative way to own premier real estate across the United States to create and preserve long-term wealth.

Financial well-being rooted in secure cash-flowing real estate.

Our Principles:

Industry Leaders

Premier Assets

Peace of Mind

Own Premier Real Estate with Lower Fees, Lower Risk & Greater Control

Invest in Class A Commercial Real Estate.

Tigerblocks targets institutional-quality, Class A properties in prime U.S. locations—assets known for strong locations, high-quality construction, and creditworthy tenants. Our aim is straightforward: durable income and long-term value growth, with transparent fees and tax-aware structures you can understand.

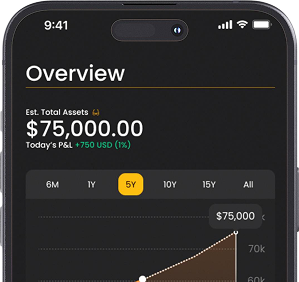

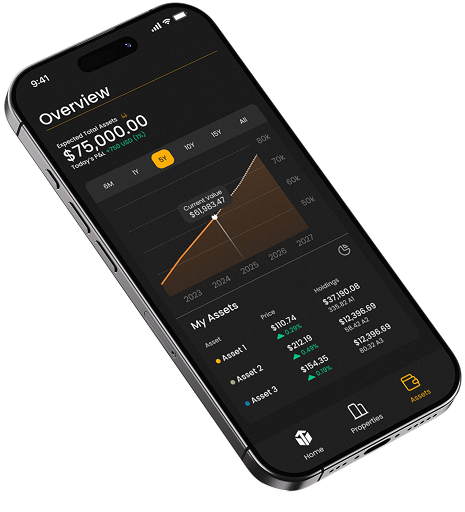

Built around your goals.

Every investor’s needs are different. We listen first, then match you to opportunities that fit. Our self-directed, single-asset funds give you direct exposure to individual properties and clear, plain-English reporting—one asset at a time.

The Value of True Ownership

Long-Term

Perspective

We believe good real estate should provide greater compounding returns without forced events caused by debt and private equity churn.

Personalized

Control

We believe our clients should be able to control where, how, and when they deploy, leverage and harvest their real estate investment capital.

Why Tigerblocks?

Our team is dedicated to ensuring access to premier multifamily assets without the traditional load of private equity fees.